- PRECIOUS GEMSTONE

-

GEMSTONES

- SEMI-PRECIOUS GEMSTONES

- BIRTH STONES

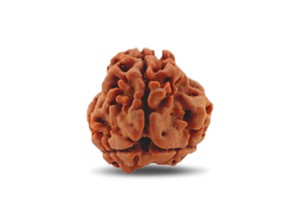

- RUDRAKSHA

Why Is Gemstone Investment Becoming a Wealth-Building Trend?

In the ever-evolving landscape of investment opportunities, a shimmering trend is capturing the attention of savvy investors—gemstone investment. Traditionally viewed as a luxury purchase, gemstones are now emerging as a viable alternative asset class. From emeralds to sapphires, these precious stones are proving to be more than just beautiful adornments; they are becoming a new way to build and preserve wealth.

Why Gemstones? The Appeal of Tangible Assets

In a world where stocks can crash and currencies can devalue overnight, tangible assets like gemstones offer a unique appeal. Unlike other investments, gemstones are portable, durable, and have intrinsic value that doesn’t fluctuate wildly with market trends. This makes them an attractive option for those looking to diversify their portfolio and protect their wealth against economic uncertainties.

The Rising Demand for Gemstones

The demand for high-quality gemstones has been steadily increasing, driven by a combination of factors. First, there's a growing appreciation for the rarity and beauty of these stones, particularly among high-net-worth individuals and collectors. Additionally, the expanding middle class in emerging markets like China and India is fueling demand for luxury items, including gemstones.

Moreover, celebrities and influencers have contributed to the rising popularity of gemstones by showcasing them in red-carpet events and social media, further driving up their desirability. This has led to a surge in gemstone prices, making them an attractive investment for those who can acquire them.

Factors to Consider Before Investing

While gemstone investment can be lucrative, it’s not without its risks. Here are some key factors to consider:

Quality and Rarity: The value of a gemstone is heavily influenced by its quality and rarity. Factors such as color, clarity, cut, and carat weight play a crucial role in determining a stone's worth. Rare stones like Kashmir sapphires or Colombian emeralds can command exceptionally high prices.

Certification: Always ensure that the gemstones you invest in come with a certificate from a reputable gemological laboratory. This certificate verifies the stone's authenticity and provides details about its characteristics, which are essential for determining its value.

Market Trends: Like any investment, it’s essential to stay informed about market trends. While gemstones have historically appreciated in value, market conditions can change. Keeping an eye on global demand, economic conditions, and emerging markets can help you make informed decisions.

Liquidity: While gemstones can appreciate in value, they are not as liquid as stocks or bonds. Selling a gemstone can take time, and the process often involves finding the right buyer who appreciates its true value.

The Future of Gemstone Investment

As the world becomes more uncertain, the appeal of tangible assets like gemstones is likely to grow. Investors are increasingly looking for ways to diversify their portfolios, and gemstones offer a unique blend of beauty, rarity, and value retention.

Moreover, as technological advancements improve gemstone authentication and trading platforms, it will become easier for investors to buy and sell gemstones, further boosting their attractiveness as an investment.

Conclusion

Gemstone investment is more than just a trend; it’s a burgeoning opportunity for those looking to diversify their portfolios with tangible assets. However, like all investments, it requires careful consideration, research, and a keen eye for quality. With the right approach, investing in gemstones can be a rewarding way to preserve and grow your wealth while enjoying the timeless beauty of these magnificent stones.

My Account

Contact Info

- Address: 28, 7th Street, Tatabad, Coimbatore, Tamil Nadu - 641012, India.

- Phone: +91 7264 999 000

- Email: eloragems@gmail.com

Blue Sapphire (Neelam)

Blue Sapphire (Neelam)  Cats Eye (Vaiduryam)

Cats Eye (Vaiduryam)  Emerald (Maragadham)

Emerald (Maragadham)  Hessonite (Gomed)

Hessonite (Gomed)  Pearl (Muthu)

Pearl (Muthu)  Red Coral (Pavalam)

Red Coral (Pavalam)  Ruby (Manik)

Ruby (Manik)  Yellow Sapphire (Pukhraj)

Yellow Sapphire (Pukhraj)  Alexandrite

Alexandrite  Alexandrite Cats Eye

Alexandrite Cats Eye  Carving Gem Stones

Carving Gem Stones  Padparadscha Sapphire

Padparadscha Sapphire  Tanzanite

Tanzanite  Agate

Agate  Amber

Amber  Amethyst

Amethyst  Apatite Cat's Eye

Apatite Cat's Eye  Aquamarine

Aquamarine  Aventurine

Aventurine  Azurite

Azurite  Beryl

Beryl  Black Tourmaline

Black Tourmaline  Bloodstone

Bloodstone  Blue Topaz

Blue Topaz  Calcite

Calcite  Green Sapphire

Green Sapphire  Navratna

Navratna  Pink Sapphire

Pink Sapphire  Pitambari Neelam

Pitambari Neelam  Sapphire

Sapphire  Star Ruby

Star Ruby  Star Sapphire

Star Sapphire  White Coral

White Coral  White Sapphire

White Sapphire  January Birthstone

January Birthstone  August Birthstone

August Birthstone  October Birthstone

October Birthstone  December Birthstone

December Birthstone  1 Mukhi Rudraksha

1 Mukhi Rudraksha  2 Mukhi Rudraksha

2 Mukhi Rudraksha  3 Mukhi Rudraksha

3 Mukhi Rudraksha  4 Mukhi Rudraksha

4 Mukhi Rudraksha  5 Mukhi Rudraksha

5 Mukhi Rudraksha  6 Mukhi Rudraksha

6 Mukhi Rudraksha  7 Mukhi Rudraksha

7 Mukhi Rudraksha  8 Mukhi Rudraksha

8 Mukhi Rudraksha  9 Mukhi Rudraksha

9 Mukhi Rudraksha  10 Mukhi Rudraksha

10 Mukhi Rudraksha  11 Mukhi Rudraksha

11 Mukhi Rudraksha  12 Mukhi Rudraksha

12 Mukhi Rudraksha